August 31, 2020

Will home prices fall after the COVID-19 pandemic?

- Unemployment rate is firmly above 10%.

- GDP shrunk +30% in Q2 2020, the largest decrease since the Great Depression

- U.S deaths from COVID-19 are approaching 200,000

At the same time, investors tend to bid up the price of gold when anticipating an economic downturn. At the time of this writing, gold is $1,900 per ounce which is crazy high. The last time gold was this expensive was in Dec of 1979 – the U.S. economy was in freefall, there was an oil crisis, America had lost faith in its leadership, and inflation was 11% and rising. The cost of home ownership was also about to increase to the increase in the Fed funds rate, and the housing market would take a beating over the next 5 years The residential real-estate market has steadily increased since the crash of 2008. The median price for a single family home is around $270,000, which is almost exctly where it was in 2006 at its height before falling a whopping 27% to $190,000. So we have a perfect storm where home prices will have to decrease – perhaps even plummet – right?

Home prices 2020 vs 2019

While the facts above paint an absolutely abysmal economic picture, home prices are actually up in 2020.

The national median existing single-family home price in the first quarter of 2020 was $274,600, up 7.7% from the first quarter of 2019 ($254,900).

This would initially seem to make little sense, given the glut of negative economic news and seemingly nothing very economically positive on the horizon. But it’s the case. How is this possible, and what do the reasons tell us about what the housing market will do in the future? If one looks at the some of the current conditions, it becomes less surprising.

- The stock market is up. After a crash in March 2020 with the outbreak of COVID-19, the US stock market crashed but then quickly rebounded over 30%. Despite all the terrible economic news, if you invested a dollar on Jan 1, 2020, you would have made money. I could write many articles as to why this might be, but let’s just focus on the fact that investors feel more flush given the unrealized gains they are sitting on. And this is positive for home prices.

- Disposable income is up. Disposable income is the amount that a family or household has at the end of the month that it can save or use for discretionary items (i.e. vacations). When consumers have more discretionary income, they are more likely to pay closer to the asking price of a house. They are more likely to buy in general. Given that the majaority of Americna households could not come up with $400 in an emergency, you can assume that average discretionary income is typically low. It does not take a large amount of money to signficantly sway it, and that’s exactly what the COVID-19 Economic Impact Payments did. The maximum payment was $1,200 and during the summer of 2020, many Americans have actually been making more money than they were while employed.

- Morgage rates are down. The “Federal Funds Rate” is what controls the mortgage rates that we pay. If the Fed Fund Rate goes down, mortage rates go down and vice-versa. The Fed Funds Rate has been historically low since 2009, and consequently, mortgage rates are an all-time low. A fixed 30-year fixed rate mortgage today is 2.85%. In that December 1979 example above, the 30-year fixed rate was 12.90%. That is a big deal. It means that buying a $300,000 house with a 20% downpayment today costs you $1,460 per month LESS than it did in 1979 (adjusted for inflation). That is $17,520 per year that home owners today get back in their pocket to spend on other stuff.

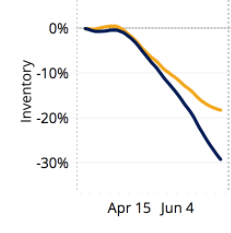

- Housing inventory is low. This is one of the most is signficant factors in propping up home prices today, and people do not talk about it enough. Just look at this graph from the Zillow 2020 Urban-Suburban Market Report.

So there are your reasons that home prices are up 2019 vs 2020. The real question – what happens now?

Will home prices keep increasing?

To answer this question, we need to look at the four reasons that home prices have increase so far, and ask ourselves, “Will they continue?”

- The stock market is up – CHANGE EXPECTED. If I was smart enough to predict every move of the stock market, I would be making a whole lot more money than I do. I don’t know if the stock market will go up or down in the next year. But I predict that we will have seen a major correction downwards in the next two years, and it will likely be lower in one year than it is today. Why? First, we have been on a 12-year bull run. Markets are meant to go up and down. They cannot go up forever unless the underlying assets/GDP are steadily increasing, and they are not.

- Disposable income is up – CHANGE EXPECTED. The US Economic Impact Payments stopped in late-July 2020. There may be additional payments, but Congress has not approved anything and any future immediate payments would almost certainly be smaller. Already huge names have declared bankruptcy during the pandemic, such as J.Crew, Gold’s Gym, Neiman Marcus, JC Penney, Hertz, and Cirque du Soleil. Yelp! estimates that there have been 91,000 permanent small business closures in the last six months. That is abolutely unprecedented, and each closure negatively impacts jobs and other businesses in the community. Short of more government stimulus packages, there is only data to suggest that disposable income will decrease – and perhaps drastically.

- Mortgage rates are down – UNCHANGED. I was considering buying a house in 2016, and I remember thinking, “I better hurry before mortgage rates increase.” The rates were historically low, and I thought it must be a rare opportunity. Four years later, and rates are even lower with the Fed now committing not to raise them for another five years. In my opinion, the low rates along with increase money supply will put the United States in a dangerous inflationary period soon as well as erode the value of the dollar as the world’s currency. But for the purposes of your mortgage rates – I don’t think they will be increasing anytime soon.

- Housing inventory is low – CHANGE EXPECTED. It’s not immediately clear why so few people have been willing to sell their homes in 2020, but one obvious reason is that no one wants a bunch of strangers walking through their homes right now. And they probably don’t want to interact with movers and other strangers as well. So it stands to reason thta people have postponed moving, but that means they likely still want to move next year. Unless the COVID-19 pandemic gets worse (possible…but let’s hope not), I expect home inventories to increase back to normal levels in 2021 and possibly higher than normal levels. This factor alone could be enough to decrease home priced in 2020 vs 2021.

- Mortgage default rates are low – CHANGE EXPECED. The St. Louis Fed posts data showing the mortgage delinquency rates on single family homes over time. It peaked at a whopping 11.54% in early 2010, and real-estate prices tanked. But today, it is at just 2.49%. Given the tighter lending requirements enacted as part of the Dodd-Frank Act, I do not expect mortgage defaults to come anywhere near the level of 2010. But as home owners lose jobs and money, I could certainly see them doubling or even tripling.

The Summary

Due to the predictions above, I do not see a scenario where home prices increase in 2021. I think it is more likely that home prices decrease slightly in 2021 due to additional inventory and the beginning of an economic recession. I think it’s likely that the recession worsens, the stock market drops, and home prices continue to falter. The timeline for that is unclear. Does this mean that you should not buy a house right now? No. I think that anyone who thinks they will be in a home for five years or more should consider buying. But it means that you should look at your house as an expense – not a retirement plan. I often see homes for sale right now that are listed lower than the price sold in 2004-2006. That home owner probably had a huge chunk of his or her net worth in that down payment, and they likely thought it would be a good investment. They would have done better putting their money in stocks, gold, bonds, or almost any other asset.

Comments