June 8, 2017

How the internet is creating cheap loans

When was the last time you spoke to a banker? That used to be the only way to obtain a mortage, loan, or open up a checking account. But today, in just minutes, consumers can sign up online for a loan and receive funds deposited into their bank accounts in as little as 24 hours. And cheap loans have increased because of the efficiency gained with not having real brick-and-mortar stores.

But with many options available, how will you find the cheapest loan?

BrightRates.com lets you enter some basic information about the loan you need, and they instantly search their database of lenders to match you with the the best one. It’s absolutely FREE, and you will be amazed at how quickly you see your results and can be approved for loans. In addition:

- You don’t have to submit your social security info

- BrightRates does not effect your credit score

- Loans are from $500 up to $35,000

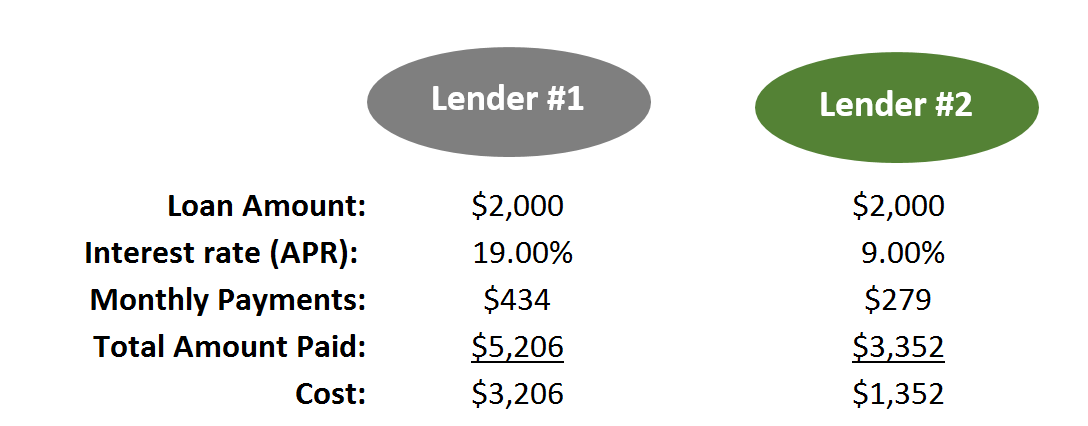

In the example below, there are two identical loans for $2,000 but Lender #2 charges a lower interest rate.

Lender #2 saves the borrower $1,854 for the exact same loan

So how do you find Lender #2? Visit BrightRates.com and type in your name, email, type of credit (if you know it) and the amount you’d like to borrow. Then follow the steps to see if you qualify.

By the Numbers

The average American household has credit card debt of $5,700, and much of this is in the form of credit card debt. Credit card debt is often at very high interest rates. Online lenders can provide interest rates that are significanly lower that the typical credit card, so a borrower can move this debt over and instantly save money each month.

So why don’t more people eliminate their credit card debt?

Because they don’t have the time to compare interest rates. This is what BrightRates.com makes easy.

For a long time, there was not easy way to compare interest rates. You had to either check each site one-by-one or actually drive to individual banks and talk to bankers. So people ended up paying interest rates higher than they might have paid if they shopped around.

But there’s one easy rule you have to follow. You have to compare rates. Don’t even consider taking out a loan without doing this first. After all the results we’ve seen, we couldn’t believe how much interest some people had been paying on loans when they could have been paying less. And some people were denied loans from a lender and gave up – when there were multiple others that would have said yes! With free services like BrightRates.com finding the cheapest loan and ensuring that you aren’t accidentally costing yourself money is a breeze.

There are some states where finding a loan is particularly difficult. But when we checked, BrightRates.com had lenders that could match with a loan in all 50 states.

Follow these steps to find the best loan for you instantly:

- Visit BrightRates.com

- Enter the amount you want to borrow, what you would like to use the money for, and your credit tier

- Get matched with lenders

- Apply right on the lenders’ websites. You can apply with more than one lender.

Comments